38 what is the duration of a zero coupon bond

Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years. The One-Minute Guide to Zero Coupon Bonds | FINRA.org After 20 years, the issuer of the bond pays you $10,000. For this reason, zero-coupon bonds are often purchased to meet a future expense such as college costs or an anticipated expenditure in retirement. Federal agencies, municipalities, financial institutions and corporations issue zero-coupon bonds.

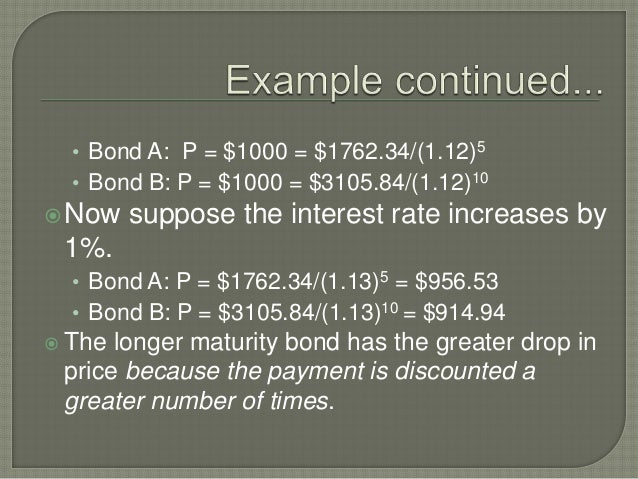

Zero-coupon bond - Wikipedia A zero coupon bond always has a duration equal to its maturity, and a coupon bond always has a lower duration. Strip bonds are normally available from investment dealers maturing at terms up to 30 years. For some Canadian bonds, the maturity may be over 90 years. [citation needed]

What is the duration of a zero coupon bond

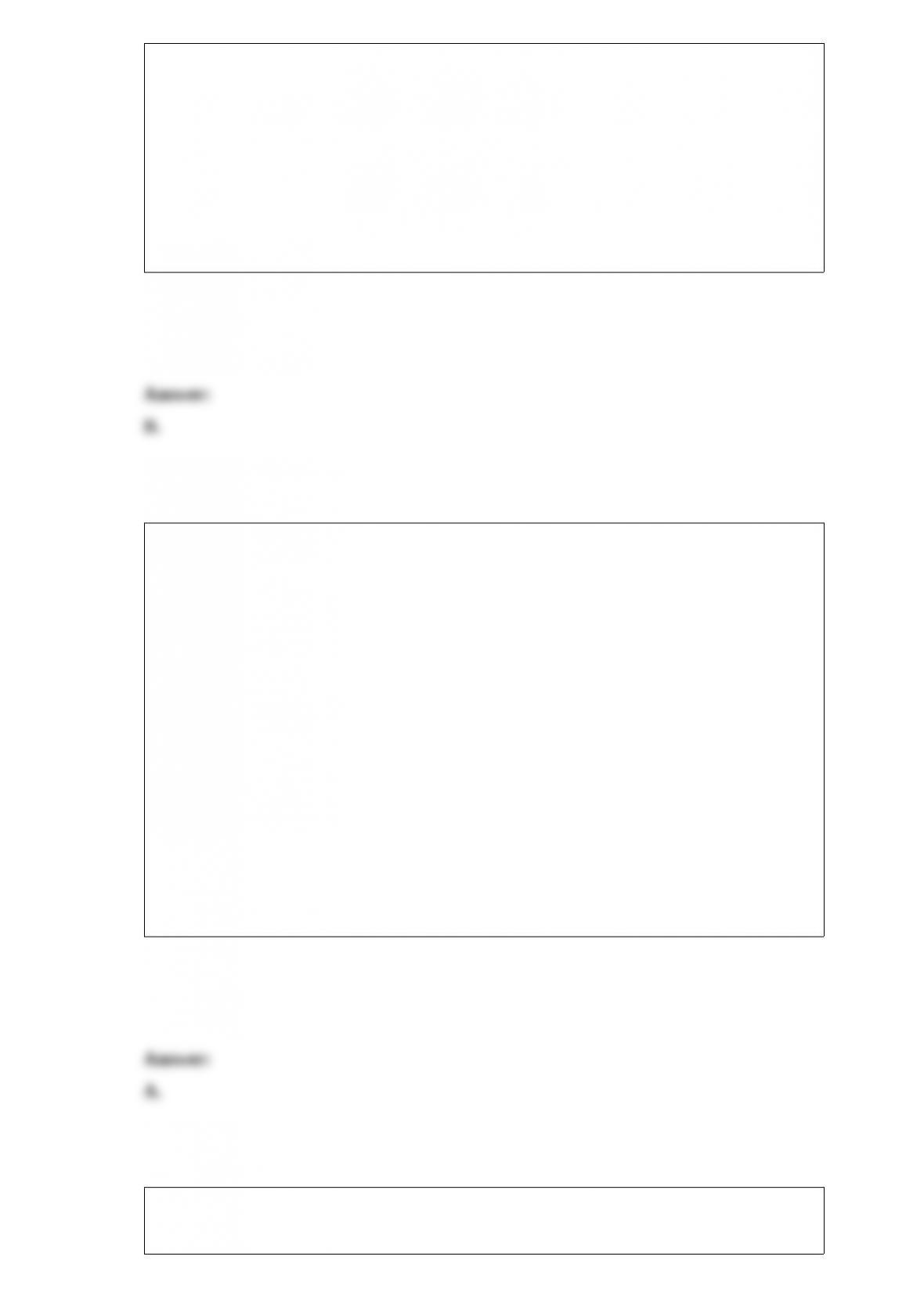

Solved 37. What is the duration of a zero-coupon bond that | Chegg.com Question: 37. What is the duration of a zero-coupon bond that has 7 years to maturity? What is the duration if the maturity increases to 10 years? If it increases to 12 years? (니 \ ( L G \) 3-7) This problem has been solved! See the answer Show transcribed image text Expert Answer 100% (1 rating) Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia The responsiveness of bond prices to interest rate changes increases with the term to maturity and decreases with interest payments. Thus, the most responsive bond has a long time to maturity...

What is the duration of a zero coupon bond. Solved a. What is the duration of a zero-coupon bond that | Chegg.com Finance questions and answers. a. What is the duration of a zero-coupon bond that has ten years to maturity? b. What is the duration if the maturity increases to 11 years? c. What is the duration if the maturity increases to 12 years? a. Duration of the bond Duration of the bond c. Duration of the bond years years years. What is the difference between a zero-coupon bond and a regular bond? Zero-coupon bonds may also appeal to investors looking to pass on wealth to their heirs. If a bond selling for $2,000 is received as a gift, it only uses $2,000 of the yearly gift tax exclusion.... What Is a Zero-Coupon Bond? Definition, Advantages, Risks Essentially, when you buy a zero, you're getting the sum total of all the interest payments upfront, rolled into that initial discounted price. For example, a zero-coupon bond with a face value of... Zero-Coupon Bond: Formula and Calculator [Excel Template] Generally, zero-coupon bonds have maturities of around 10+ years, which is why a substantial portion of the investor base has longer-term expected holding periods.

For a zero-coupon bond? Explained by FAQ Blog What is the duration of a zero coupon bond? Zero coupon bonds may be long or short-term investments. Long-term zero coupon maturity dates typically start at ten to fifteen years. The bonds can be held until maturity or sold on secondary bond markets. Short-term zero coupon bonds generally have maturities of less than one year and are called bills. risk management - Calculate duration of zero coupon bond - Quantitative ... Let Pz (t, T ) be the price of a zero coupon bond at time t with maturity T and continuously compounded interest rate r. Duration = − 1 P d P d r Let A and a be two constants and x be a variable. Let F ( x) = A × e a x be a function of x. Then, the first derivative of F with respect to x, denoted by d F d x, is given by Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ... Solved a. What is the duration of a zero-coupon bond that | Chegg.com a. Duration of the bond b. Duration of the bond c. Duration of the bond years years years ; Question: a. What is the duration of a zero-coupon bond that has eight years to maturity? b. What is the duration if the maturity increases to 10 years? c. What is the duration if the maturity increases to 12 years? a. Duration of the bond b.

Zero Coupon Bond Calculator - Nerd Counter Both of these words represent the common zero coupon bond term. Zero Coupon bond is also named as accrual bond and it lacks the coupons or the installments procedure for making the payments; instead, a single payment at the level of maturity (the time period or the duration) is paid. Zero-Coupon Bond Definition - Investopedia The maturity dates on zero-coupon bonds are usually long-term, with initial maturities of at least 10 years. These long-term maturity dates let investors plan for long-range goals, such as saving... Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding What is the duration of a zero coupon bond? - Quora Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount with par value paid on redemption, sometimes with a nominal premium.

Zero Coupon Bond: Formula & Examples - Study.com Zero-Coupon Bond Formula: Zero-coupon bonds are real-life applications of the time value of money concept which underlines that $100 now is worth more than $100 in the future.

For zero coupon bonds? - blog.chicle.rescrf.com A zero coupon bond is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money. It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond.

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Zero-coupon bonds are those bonds that are sold at a deep discount to their face value. This means that these bonds do not receive any periodic interest. Instead, the investors have to invest a lump sum amount at the beginning of their investment and get paid a higher lumpsum amount at the end of their investment.

What is zero coupon bonds? - myITreturn Help Center Zero-coupon bond (also discount bond or deep discount bond) is a bond bought or issued at a price lower than its face value and the face value repaid at the time of maturity. It does not make periodic interest (coupon) payments. Hence the term is called as zero-coupon bond. When the bond reaches maturity, its investors receive its par (or face ...

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price = FV / (1 + IR) N...

Post a Comment for "38 what is the duration of a zero coupon bond"