38 coupon rate and market rate

home.treasury.gov › interest-rate-statisticsInterest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data › what-is-the-coupon-rateWhat Is the Coupon Rate of a Bond? - The Balance The coupon rate of a bond or other fixed income security is the interest rate paid out on the bond. When the government or a company issues a bond, the rate is fixed. The coupon rate is stated as an annual percentage rate based on the bond's par, or face value. The dollar amount represented by this coupon rate is paid each year—usually on a ...

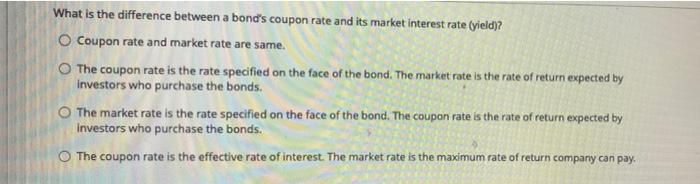

What is the difference between coupon rate and market - Course Hero The market can also give a premium rate that is greater, than a discount rate. The reason its called a coupon rate is that before electronic investing each bond that was issued is made of paper called coupons. These were issued to redeem for money. The rate of interest, the amount of interest, the bond holder receives, based on the bonds normal ...

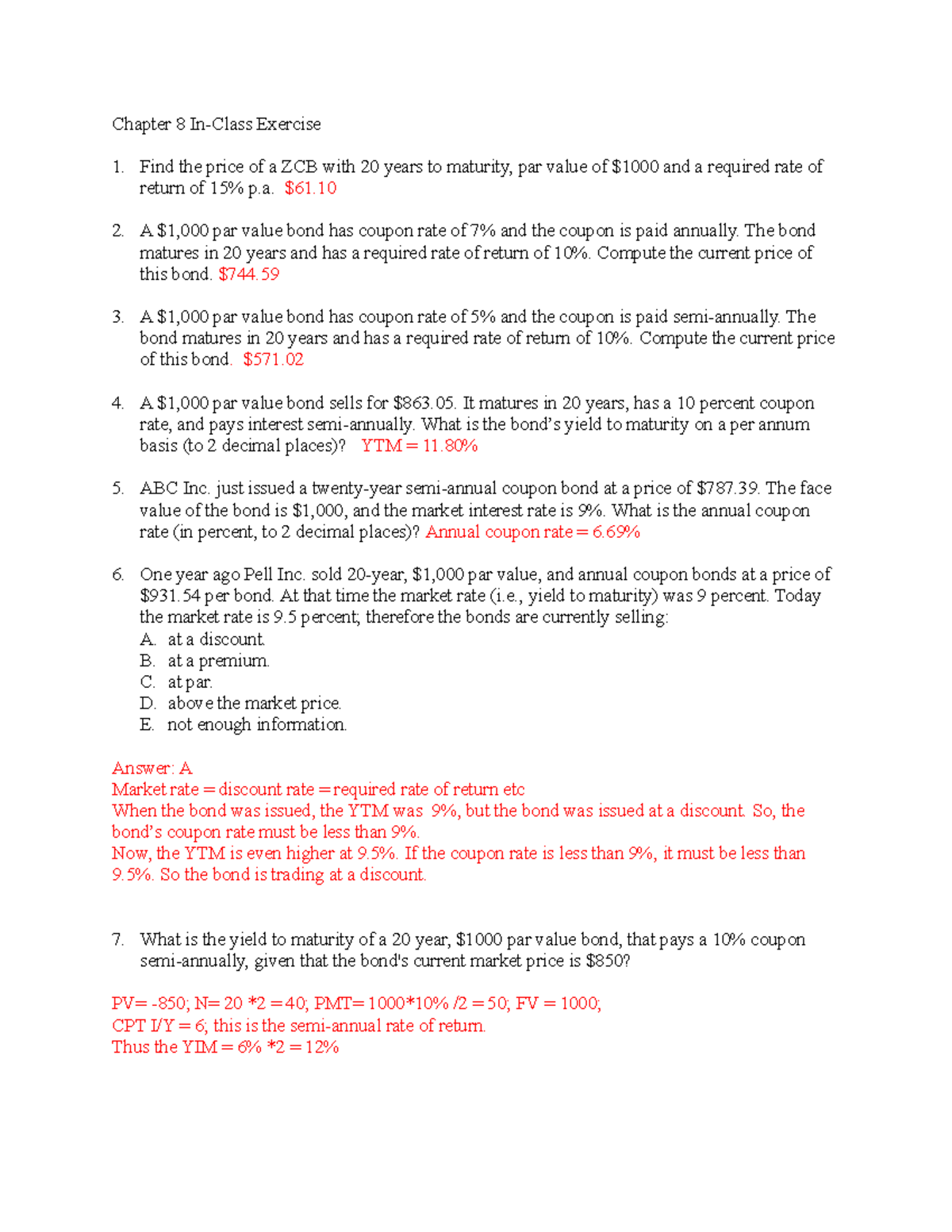

Coupon rate and market rate

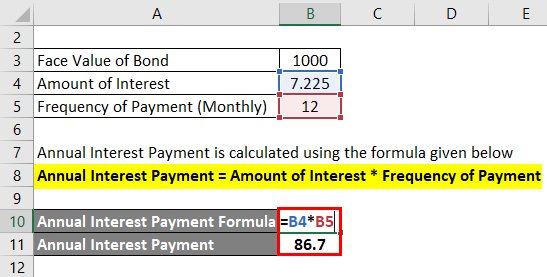

Coupon Rate - Explained - The Business Professor, LLC Apr 17, 2022 ... Changes in the market interest rates affect the results of a bond investment. The bondholder is likely to receive a low-interest payment if the ... Bonds - Coupon and Market Rates Differ - YouTube Lesson discussing how the value of a bond changes when coupon rates and market rates differ. Looks at why a bond will trade at a premium, discount, or at par For more questions, problem... Coupon rate definition — AccountingTools What is a Coupon Rate? A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

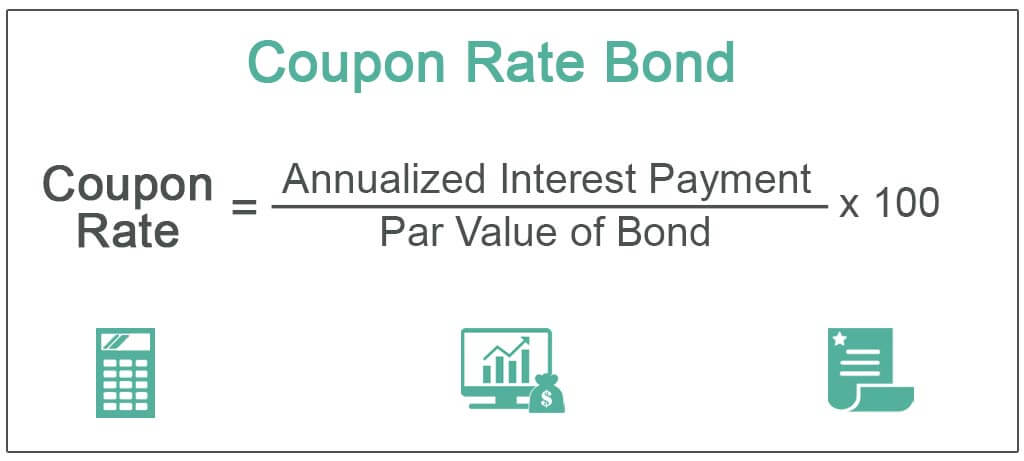

Coupon rate and market rate. What Is Coupon Rate and How Do You Calculate It? - SmartAsset The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. In our example above, the $1,000 pays a 10% interest rate. Investors use the phrase "coupon rate" for two reasons. Interest Rates and Bond Pricing - Morningstar When a bond is issued, it pays a fixed rate of interest called a coupon rate until it matures. This rate is related to the current prevailing interest rates ... Difference Between Coupon Rate and Interest Rate The coupon rate is normally used in the bonds, which is an income to the holder after paying the rate on certain purchased items. Interest rate is a reduction to the borrower by paying back the amount he/she has borrowed. The coupon Rate ends according to the maturity period mentioned by the bondholder while issuing the bond. How To Find Coupon Rate Of A Bond On Financial Calculator Coupon Rate = (Coupon Payment / Par Value) x 100 For example, you have a $1,000 par value bond with an annual coupon payment of $50. The bond has 10 years until maturity. Using the formula above, we would calculate the coupon rate as follows: Coupon Rate = ($50 / $1,000) x 100 = 5% Own or Dealer Bid

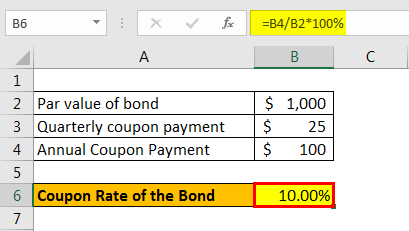

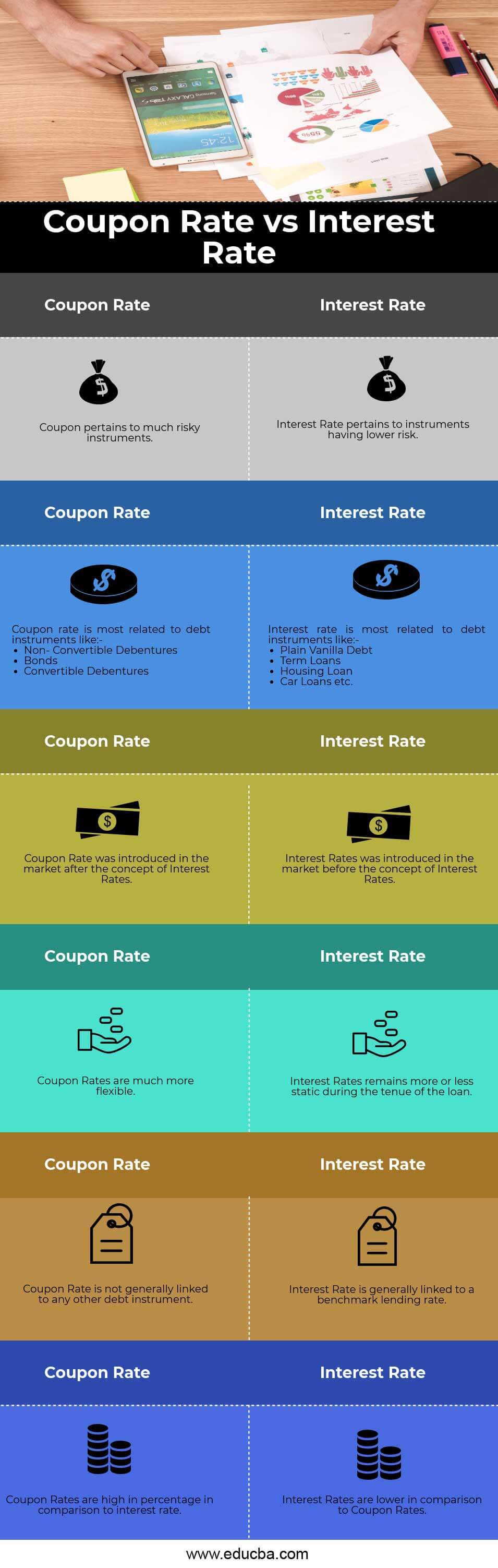

Coupon Rate vs Interest Rate | Top 6 Best Differences (With ... - EDUCBA On the other hand, a Coupon rate is introduced where the risk profile of the borrower is high and the borrower needs re-finance or needs to go off from immediate cash outflow of its debt obligations which makes the company let go of the heavy principal payment which is due in the coming quarter or year Coupon Rate vs Interest Rate Comparison Table Coupon Rate - Definition - The Economic Times The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 ... Coupon Rate Formula | Step by Step Calculation (with Examples) Dave said that the coupon rate is 10.00% Harry said that the coupon rate is 10.53% Annual Coupon Payment Annual coupon payment = 4 * Quarterly coupon payment = 4 * $25 = $100 Therefore, the coupon rate of the bond can be calculated using the above formula as, Coupon Rate of the Bond will be - Therefore, Dave is correct. › HotelsHotels: Search Cheap Hotels, Deals, Discounts, Accommodations ... Get a link to download the app in the Apple App Store or Google Play Store. 1 message per request. Message and data rates may apply. Text HELP for help or STOP to unsubscribe.

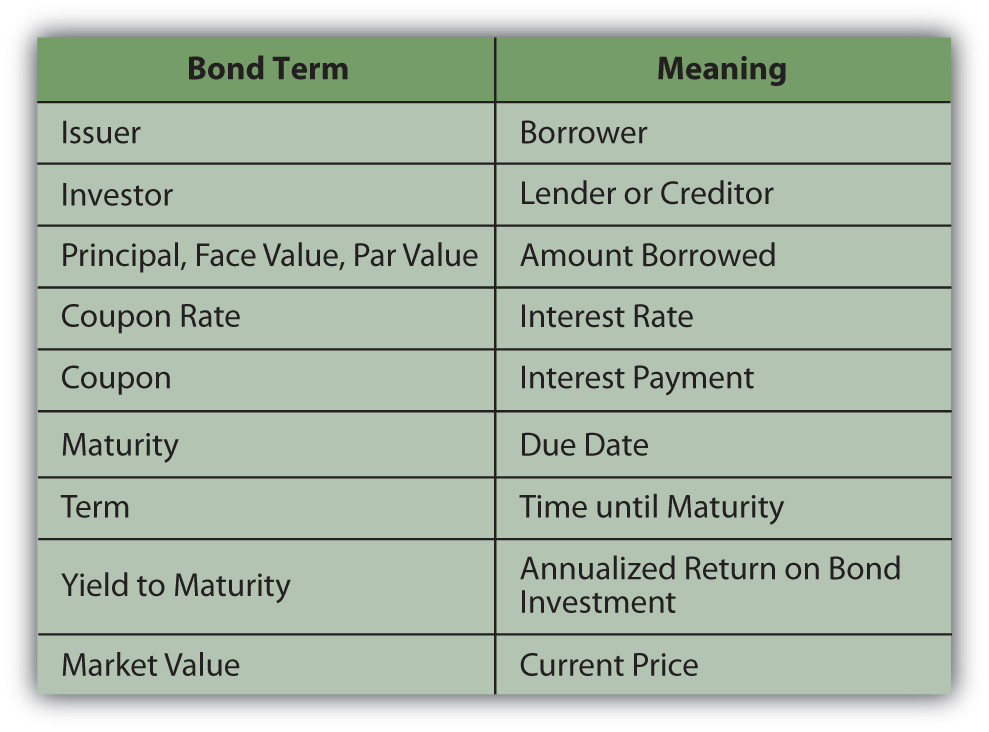

Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) What is Coupon Rate? The coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more is the rate of interest being paid off for the fixed income security such as bonds. Difference Between Coupon Rate and Interest Rate • Coupon Rate is the yield of a fixed income security. Interest rate is the rate charged for a borrowing. • Coupon Rate is calculated considering the face value of the investment. Interest rate is calculated considering the riskiness of the lending. • Coupon rate is decided by the issuer of the securities. Interest rate is decided by the lender. › newsletters › entertainmentCould Call of Duty doom the Activision Blizzard deal? - Protocol Oct 14, 2022 · The CMA is focusing on three key areas: the console market, the game subscription market, and the cloud gaming market. The regulator’s report, which it delivered to Microsoft last month but only just made public, goes into detail about each one, and how games as large and influential as Call of Duty may give Microsoft an unfair advantage. Difference Between Coupon Rate and Required Return The coupon rate is not calculated on the market value. Instead, it is calculated on the bond's face value. For example, if you have a 5 year Rs 1000 bond that has a coupon rate of 10 per cent, then irrespective of the market value of the bond price, you will receive Rs 100 every year for five years.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

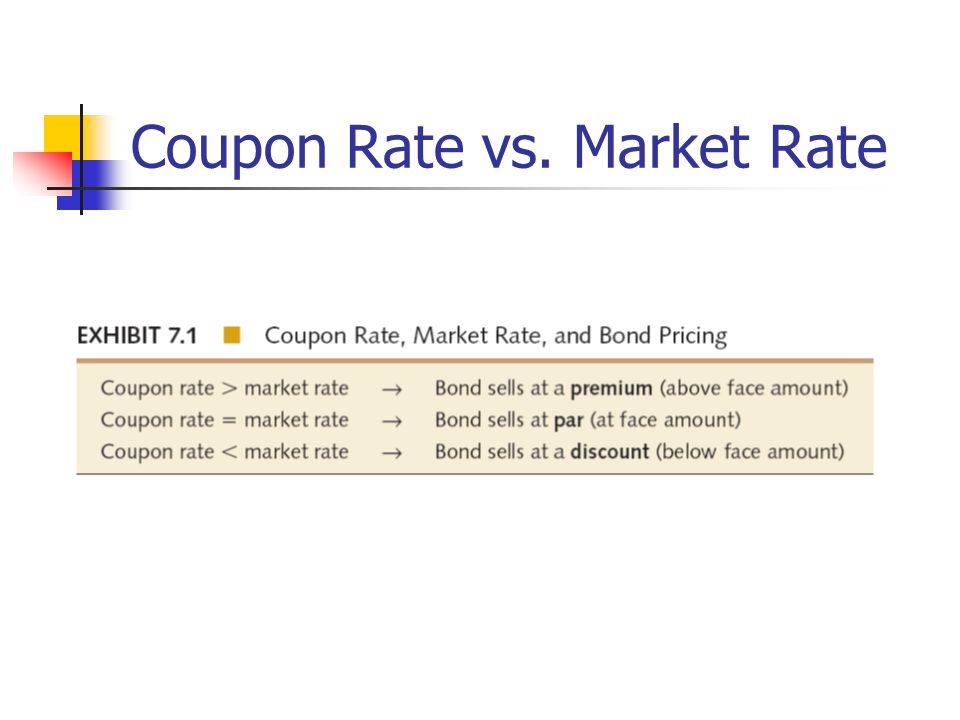

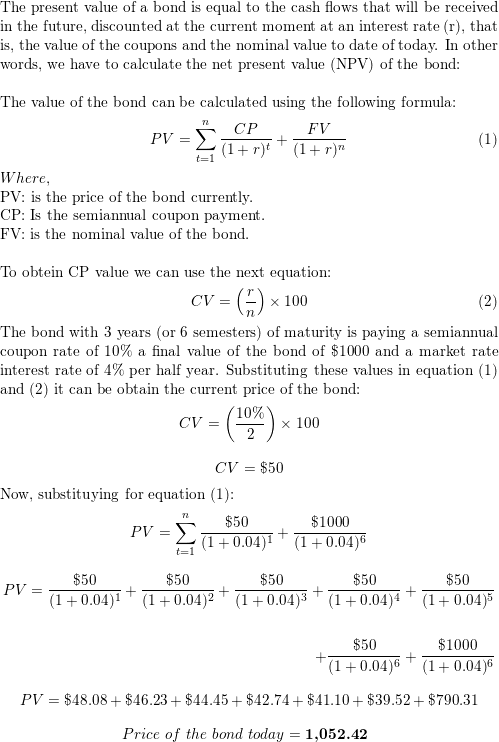

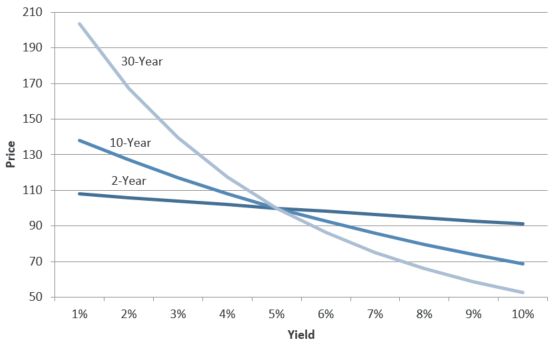

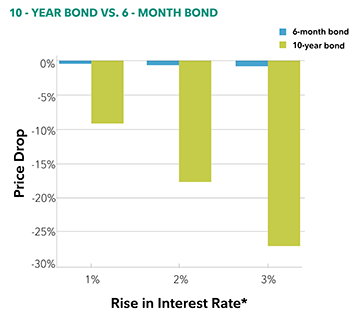

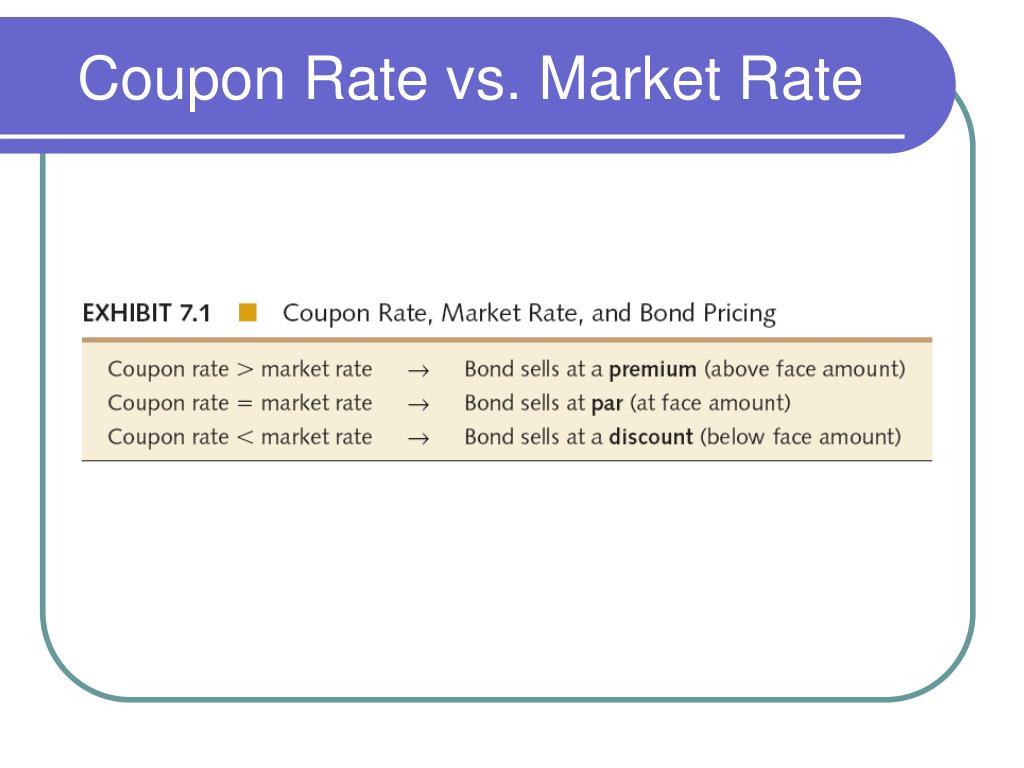

Bond's Price, Coupon Rate, Maturity | CFA Level 1 - AnalystPrep When the coupon rate is greater than the market discount rate, the bond is priced at a premium above par value. Conversely, when the coupon rate is less than the market discount rate, the bond is priced at a discount below par value. All else equal, the price of a lower coupon bond is more volatile than that of a higher coupon bond.

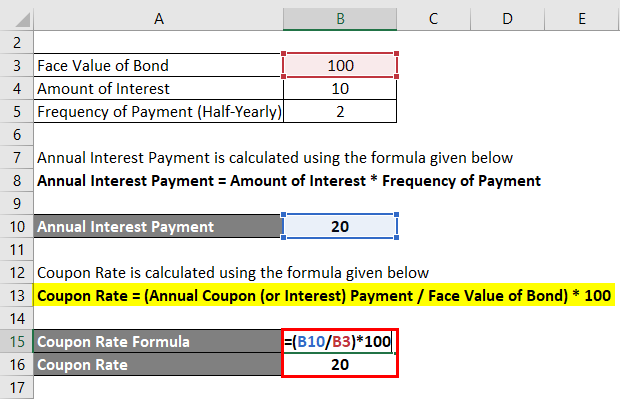

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (20 / 100) * 100; Coupon Rate = 20%; Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities. However, if the market rate of interest is higher than 20%, then the bond will be traded at discount.

Coupon Rate vs. Discount Rate - What's The Difference (With Table) Coupon Rate vs Discount Rate. The main difference between a coupon rate and a discount rate lies in how the rates are charged and the factors upon which the rates depend. A coupon rate can be described as the annual rate of interest that the bond issuer pays to the bondholder on the fixed income security whereas a discount rate can be defined ...

Bond Coupon Interest Rate: How It Affects Price - Investopedia When the prevailing market rate of interest is higher than the coupon rate—say there's a 7% interest rate and a bond coupon rate of just 5%—the price of the bond tends to drop on the...

en.wikipedia.org › wiki › Coupon_(finance)Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of ...

Concept 82: Relationships among a Bond's Price, Coupon Rate ... A bond is priced at a discount below par value when the coupon rate is less than the market discount rate. All else equal, the price of a lower-coupon bond ...

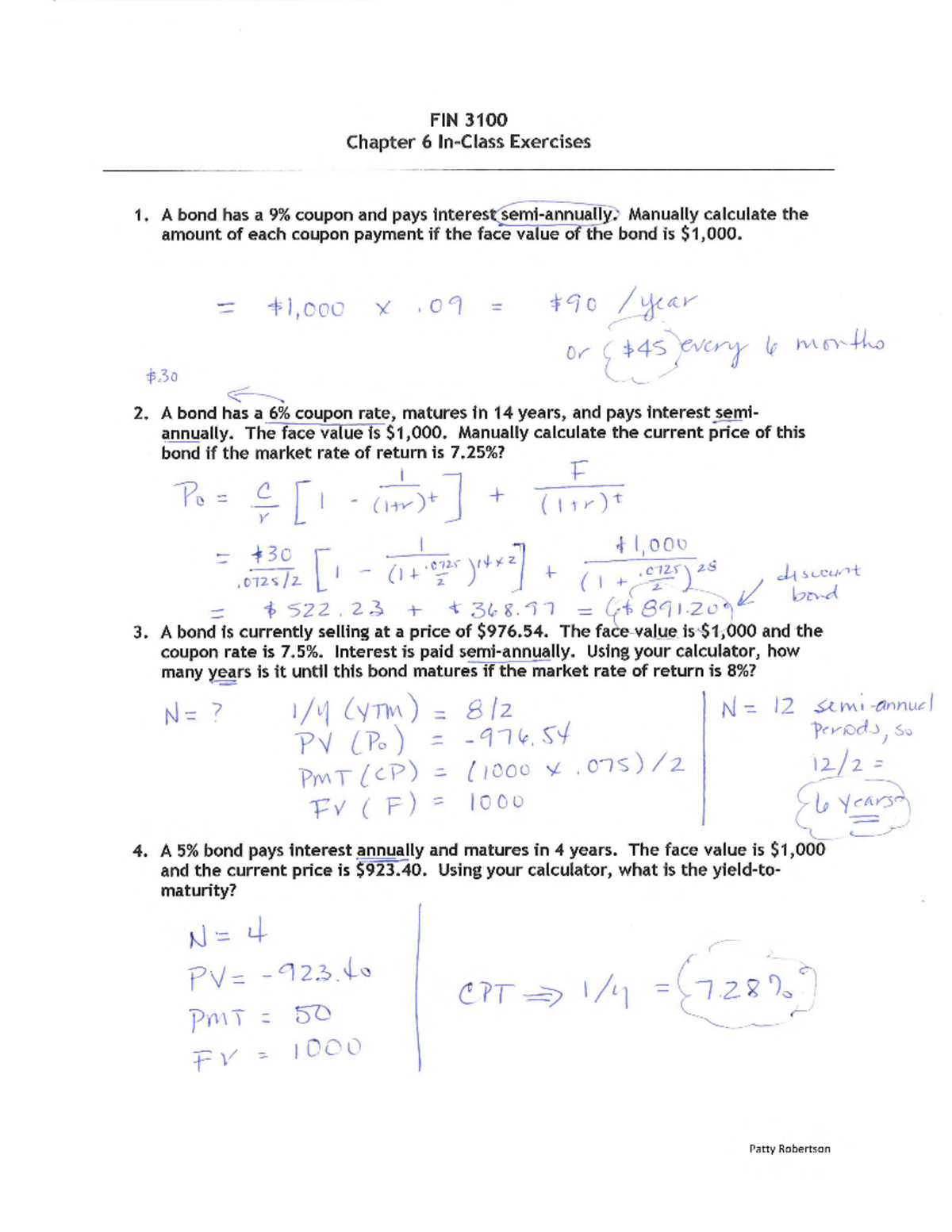

Ace has common stock with a market value of \( \$ 20 | Chegg.com The bond has a 9% coupon rate with a total face value of $20 million, a maturity of 10 years, and a yield to maturity of 10%. The coupons are paid annually. The current Treasury-bill rate is 8% and the expected market premium is 10 percent. The beta of Ace equity is 0.9. Assume 0% corporate tax rate. A. What is Ace's debt to equity ratio?

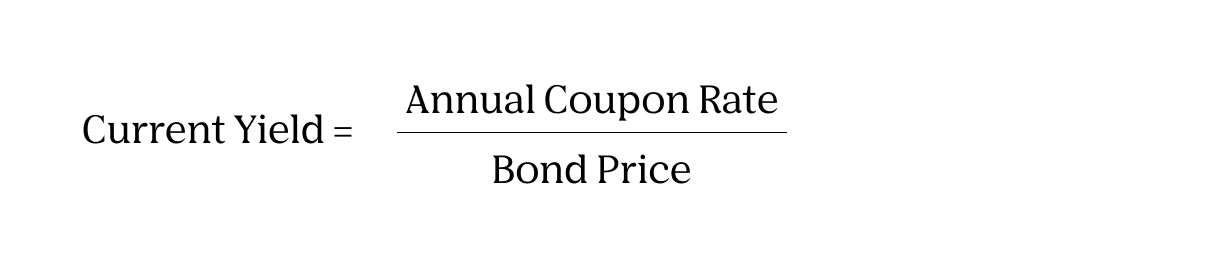

Which is Difference Between a Coupon Rate and a Yield Rate A coupon rate is the interest rate that a bond pays, expressed as a percentage of the bond's face value. For example, if a bond has a face value of 1,000 and a coupon rate of 5%, the bondholder will receive 50 in interest each year. A bond's yield is the effective rate of return, considering the effect of compounding.

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = Reference Rate + Quoted Margin The quoted margin is the additional amount that the issuer agrees to pay over the reference rate. For example, suppose the reference rate is a 5-year Treasury Yield, and the quoted margin is 0.5%, then the coupon rate would be - Coupon Rate = 5-Year Treasury Yield + .05%

What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same.

Coupon Rate Calculator | Bond Coupon And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ...

› terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Coupon Rate vs Interest Rate - WallStreetMojo The coupon rate is decided by the issuer of the bonds to the purchaser. The interest rate is decided by the lender. ... Coupon rates are largely affected by the ...

Coupon Rate Calculator | Solution Step by Step 🥇 The coupon rate is a discount on the market interest rate, so it's usually lower than what you'd receive for a personal loan or mortgage. This means that when you invest in these bonds, you'll pay less interest overall—that's why this type of bond is called an "investment" bond instead of just a "borrowing" bond.

A Bond's Price given a Market Discount Rate - AnalystPrep Solution. The correct answer is A. The yield-to-maturity is the rate that makes the sum of the discounted cash flows 102, which is 1.98%, compounded semi-annually. The bond trades at a premium because its coupon rate of 5% / 2 = 2.5% is greater than the yield required by investors. ( Cr > Mdr)

Understanding Coupon Rate and Yield to Maturity of Bonds Let's see what happens to your bond when interest rates in the market move. When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the Coupon Rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and Coupon Rate is 2.375%.

› coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... Also, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower ...

Bond Stated Interest Rate Vs. Market Rate | Pocketsense Because of the manner in which bonds are traded, the coupon rate often differs from the market interest rate. Tips A coupon rate is a fixed rate of return attached to the face value of the bond paid to the purchaser from the seller, while the market interest rate can change dramatically throughout the lifespan of the bond. Bond Basics

Finance exam 2 Flashcards | Quizlet YTM is another term for the bond's coupon rate. Reason: YTM is the prevailing market interest rate for bonds with similar features. It is also the expected return for an investor who buys the bond and holds it to maturity. The coupon rate determines the periodic interest payments made to investors.

Coupon rate definition — AccountingTools What is a Coupon Rate? A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

Bonds - Coupon and Market Rates Differ - YouTube Lesson discussing how the value of a bond changes when coupon rates and market rates differ. Looks at why a bond will trade at a premium, discount, or at par For more questions, problem...

Coupon Rate - Explained - The Business Professor, LLC Apr 17, 2022 ... Changes in the market interest rates affect the results of a bond investment. The bondholder is likely to receive a low-interest payment if the ...

Post a Comment for "38 coupon rate and market rate"