43 step up coupon bonds

step-up coupon security - TheFreeDictionary.com A callable bond issued with a low coupon rate that gradually increases over the life of the bond. The increases occur at regular intervals stated in the bond indenture.It is also called a step-up coupon security or a dual coupon bond More Coupon Step-Ups Likely Among Onshore Chinese Bonds - Fitch Ratings We counted 84 bonds that stepped up coupon rates by 2bp to 225bp on their put or call dates in 8M20, accounting for 8.7% of a total of 962 bonds with exercisable coupon-adjustment provisions bundled with put options or perpetual features. In contrast, 568 bonds, or about half of the bonds with exercisable coupon-adjustment provisions, offered ...

Step-Coupon Bond - Fincyclopedia In this sense, a step-coupon bond is similar in structure to a deferred-interest bond ( DIB) except that it is initially issued with a low coupon interest, which is later readjusted upward. A step-coupon bond may have an embedded call option which the issuer can exercise as the coupon level rises. This bond is also known as a reset bond. S 880

Step up coupon bonds

What Do I Need to Know About Step-Up Bonds? | Finance - Zacks One-step bonds have their coupon payment stepped up once during the life of the bond. For example, the coupon payment on a five-year bond may be 5 percent in the first and second... Novartis stirs debate with first social-linked step-up coupon bond In the formats used so far, investors will receive a 25bp step-up in the coupon if, on a certain date, the issuer has failed to hit a sustainability target. For Enel and Suzano, these were to... Deferred Coupon Bonds | Definition, How it works? Types, Advantages Deferred Coupon bonds help businesses acquire finance without paying periodic interest. A lump-sum is paid including interest at the time of maturity. ... a company paying 4% interest on step-up bonds defers interest payments till maturity. On maturity, the company will pay interest at an increased rate (say) 5.5% for all the deferred periods. ...

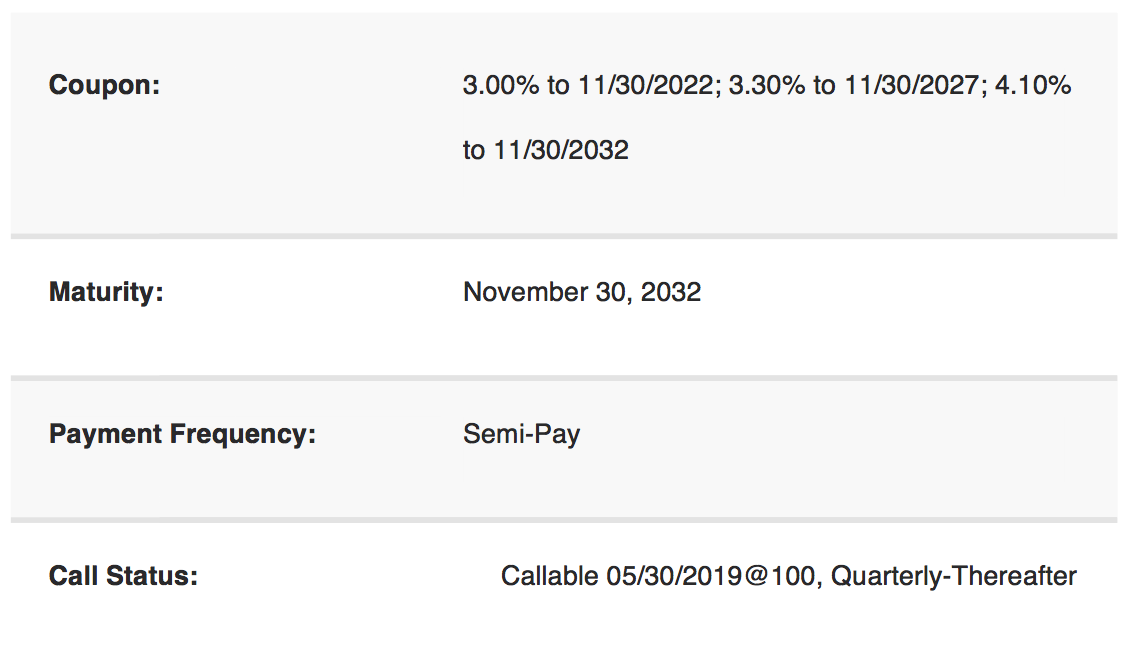

Step up coupon bonds. Step-Up Bonds Definition & Example | InvestingAnswers The initial coupon rate on a step-up bond is usually above market. Many step-up bonds are callable, which gives issuers some protection against falling interest rates. For example, if after three years the XYZ bond is paying 8% but market rates are down to 5% (Scenario A), Company XYZ would be paying a relatively high interest rate on its debt. abcnews.go.com › USU.S. News | Latest National News, Videos & Photos - ABC News ... Nov 08, 2022 · Plus, Democrats keep control of the Senate while the House is still up for grabs with key races still too close to call, and the latest on President Joe Biden’s foreign tour through Africa and Asia. Step-Up Bond Explained - moneyland.ch The coupons of a step-up bond can be seen as steps or tiers, with each coupon paying out higher yields than the previous coupon. While conventional bonds pay out an annual yield that is fixed across the bond term, the yields paid out by step-up bonds increase at intervals throughout the bond term. Typically, yields increase every year. Step-Up & Step-Down Bond - Cbonds.com Step-Up and Step-Down bonds are fixed-rate bonds characterized by a trend, determined at the issue of the bond itself, which may be respectively increasing or decreasing over time. The typical predetermined coupon structure or variable over time represents this peculiar characteristic common to both types of bonds. Example of a bond. In this case we are facing a Step-Up Bond.

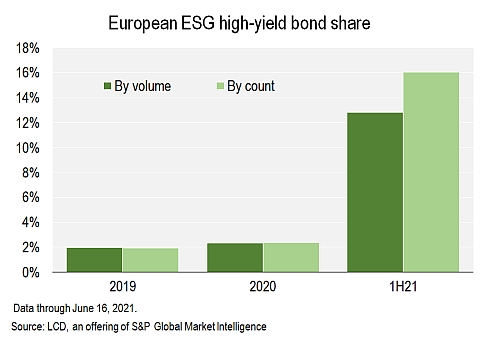

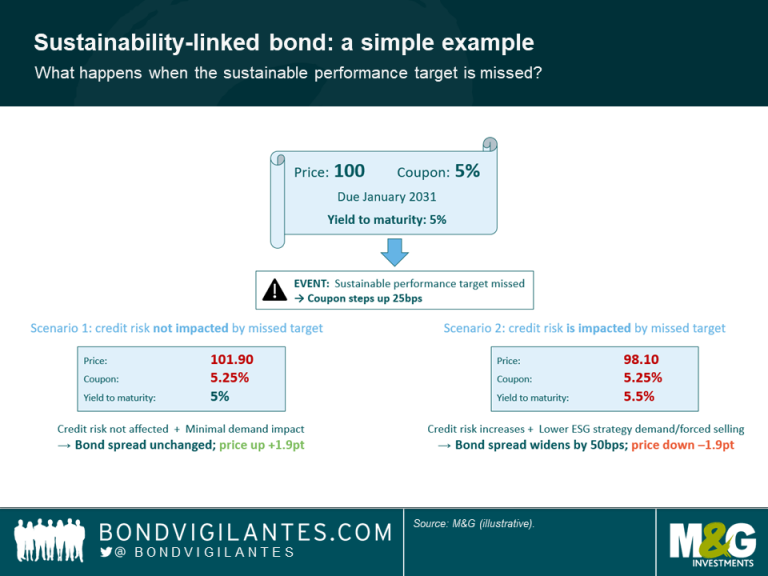

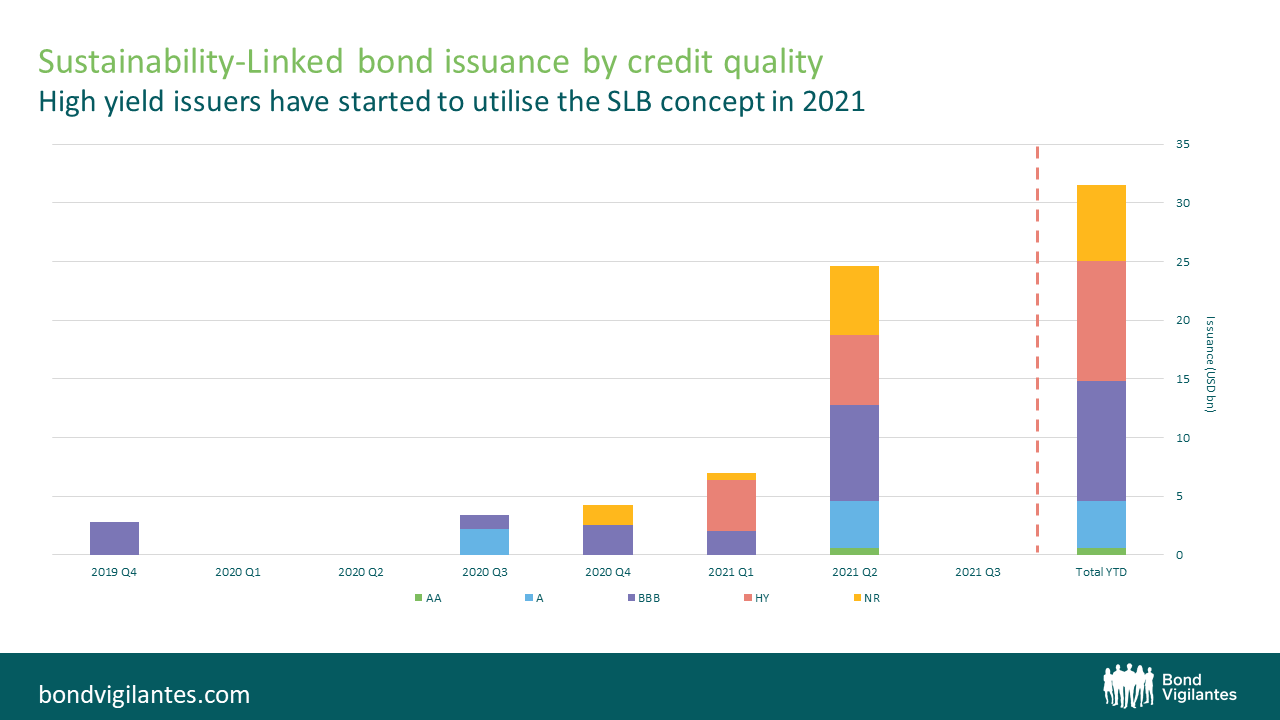

› playstation-userbasePlayStation userbase "significantly larger" than Xbox even if ... Oct 12, 2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ... Sustainability-linked bond step-ups need to be 'more material' for ... Sustainability-linked bond step-ups need to be 'more material' for firms The coupon step-ups associated with sustainability-linked bonds (SLBs) need to be "more material" for firms than is demonstrated by current market practice, according to Aviva Investors. To access this article please sign-in below or register for a free one-month trial. What are Step-up Bonds? Example, Types, Advantages, and Disadvantages The coupon rate of the bond increases to 5% in its final year. It means the lender will receive $30 for each of the first two years, $45 for year two and year three, and finally receive $50 in the last year. The lender will also receive $1,000 on the maturity of the bond, as usual. Types of Step-Up Bonds Sustainable Fitch: Sustainability-Linked Bond Step-Ups Need Refinement Sustainable Fitch's analysis of the market found no correlation between coupon step-up levels and an issuer's credit rating or the bond's overall coupon. Further differentiation of step-up rates to account for variations in the financial, operational and sustainability profiles of issuers would improve transparency for investors. Unlike ...

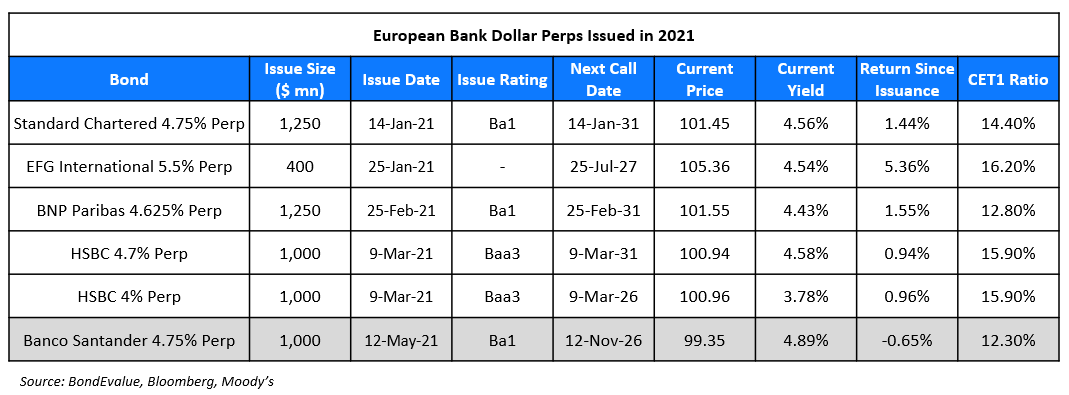

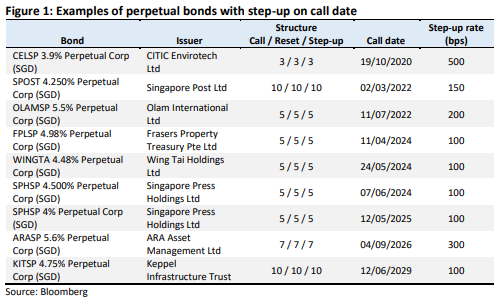

Step Up Bonds: Pros and Cons - linkedin.com Some of these advantages are mentioned below: Higher Yields: Step-up bonds are designed to provide guaranteed higher yields to investors. The bonds are created in such a way that the... Step-Up Bond Definition - Investopedia Because the coupon payment increases over the life of the bond, a step-up bond lets investors take advantage of the stability of bond interest payments while benefiting from increases... Global ESG-Linked Bond Market Faces Its First Set of Penalties The first, a €775 million security maturing in 2026, will pay a half-a-percentage-point coupon step-up if it fails to reduce direct emissions from its assets by 40% by end-2022, from a 2019 base ... Perpetual Bonds - Overview, Issuers, Advantages, Disadvantages To help mitigate the interest rate risk, the issuer of a perpetual bond may offer a step-up feature that periodically increases the coupon rate according to a set schedule. For example, the coupon rate may be increased by a fixed percentage amount once every 10 or 15 years.

› 2022/10/12 › 23400986Microsoft takes the gloves off as it battles Sony for its ... Oct 12, 2022 · Microsoft pleaded for its deal on the day of the Phase 2 decision last month, but now the gloves are well and truly off. Microsoft describes the CMA’s concerns as “misplaced” and says that ...

Why Step-Up Bonds? | Meaning, Reason, Types, Benefit, etc | eFM Step-up bonds or notes are a type of bond with a coupon rate that increases over time. These securities are called step-up bonds because the coupon rate "steps up" over time. For example, the step-up bond could have a 5% coupon rate for the first two years, 5.5% for the third and fourth years, and 6% for the fifth year.

Step Up Bonds: Pros and Cons - Management Study Guide Higher Yields: Step-up bonds are designed to provide guaranteed higher yields to investors. The bonds are created in such a way that the coupon payments in the last few years of the existence of the bonds are much larger than the expected interest rate during the same period.

Stepped coupon bond financial definition of stepped coupon bond A bond with interest coupons that change to predetermined levels on specific dates. Thus, a stepped coupon bond might pay 9% interest for the first 5 years after issue and then step up the interest every fifth year until maturity. Issuers often have the right to call the bond at par on the date the interest rate is scheduled to change.

› fintech › cfpb-funding-fintechU.S. appeals court says CFPB funding is unconstitutional ... Oct 20, 2022 · That means the impact could spread far beyond the agency’s payday lending rule. "The holding will call into question many other regulations that protect consumers with respect to credit cards, bank accounts, mortgage loans, debt collection, credit reports, and identity theft," tweeted Chris Peterson, a former enforcement attorney at the CFPB who is now a law professor at the University of Utah.

› articles › bondsUnderstanding Bond Prices and Yields - Investopedia Jun 28, 2007 · Bond Prices and Yields: An Overview . If you buy a bond at issuance, the bond price is the face value of the bond, and the yield will match the coupon rate of the bond.

What Is a Step-up Bond? - The Balance But suppose you had a step-up bond that offered 0.5% annual coupon increases. The step-up feature gives you some protection against rising interest rates. After year one, you could earn 3.5%. After year two, you'd receive 4%, and so on. However, there's no guarantee that step-ups will keep up with market rates. How Step-up Bonds Work

Step-Up Coupon Bond - Harbourfront Technologies What is a Step-Up Coupon Bond? A step-up coupon bond, or step-up bond, is a debt instrument that pays comes with a lower initial interest rate. However, it includes a feature that provides increasing rates after specific periods. There is no standard for step-up bonds to follow when it comes to interest rate increases.

Accounting for Step-Up Bond | Example | Advantage - Accountinguide Multi Step-up bond is the step-up bond in which the coupon rate increases more than one before the maturity date. Advantage of Step Up Bond. High return for investors: Investors will receive more return by investing in step-up bonds, the interest rate will keep increasing over time. If compared to normal bonds, the step-up bonds will generate ...

How to calculate the yield to maturity for a step-up coupon bond - Quora Answer (1 of 2): If you want to give me the cusip and the dollar price, I can do it for you on Bloomberg, otherwise you can plot the cash flows on your own and use your calculator or Microsoft excel Internal rate of return function. But here's the thing, the vast majority of step-up notes do NOT ...

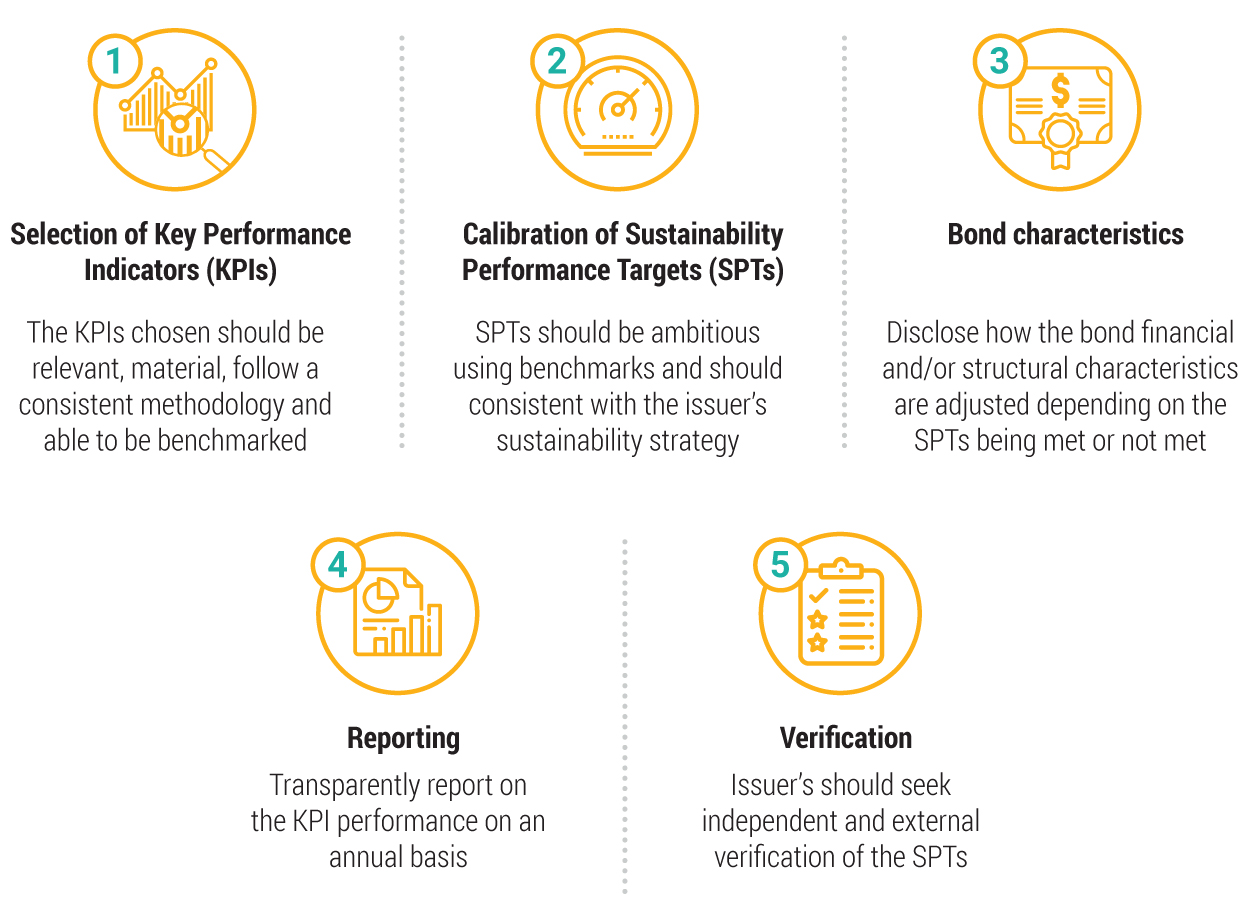

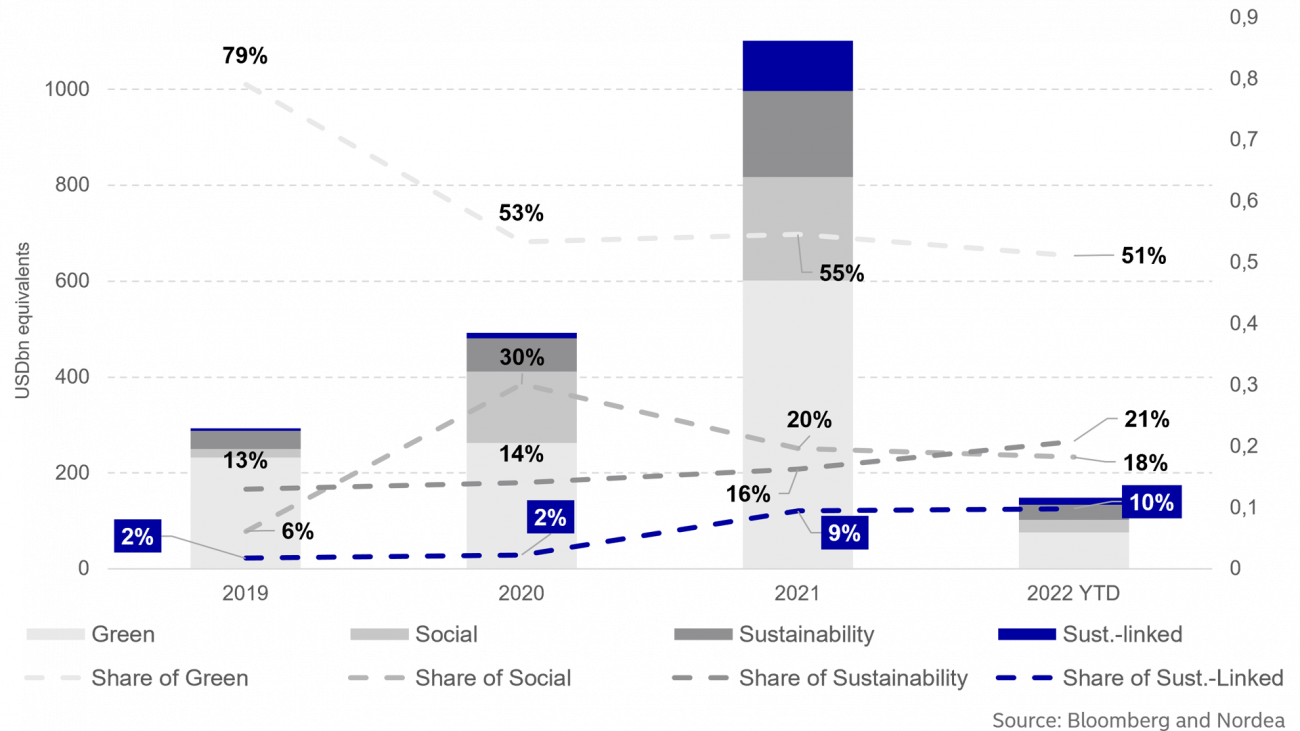

What are sustainability-linked bonds and how do they work? The coupon step-up can also be conditional on multiple objectives. Take Brazilian paper company Klabin. The company's SLBs have three KPIs, to be achieved by 2025: reduce water consumption, increase minimum reuse/recycling of solid waste and reintroduce at least two native animal species in extinction or threatened on the company's land.

Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today?

› story › moneyUnbanked American households hit record low numbers in 2021 Oct 25, 2022 · Those who have a checking or savings account, but also use financial alternatives like check cashing services are considered underbanked. The underbanked represented 14% of U.S. households, or 18. ...

What is a Step-Up Bond? - Accounting Hub Step-up bonds are a special type of bond that comes with rising interest rates. These bonds offer a low-interest rate initially and then an increased interest rate after a specific period. It can come with a single interest rate rise or multiple interest rate increases. The interest rates can also be linked with inflation rates.

› 2022/10/19 › 23411972Microsoft is building an Xbox mobile gaming store to take on ... Oct 19, 2022 · In a graph posted at Microsoft’s Activision Blizzard acquisition site, the company depicts the entire gaming market as worth $165 billion in 2020, with consoles making up $33 billion (20 percent ...

Describe Different Types of Bonds | CFA Level 1 - AnalystPrep FRNs generally have quarterly coupons. Step-up coupon bonds, either fixed or floating, have coupons that increase by specified margins at specified dates. Such bonds provide protection against rising interest rates. Credit-linked bonds have coupons that change in line with the bond's credit rating.

Step-Ups - Types of Fixed Income Bonds | Raymond James Introduction to Step-up Bonds: At the most basic level, step-up bonds have coupon payments that increase ("step-up") over the life of the bond according to a predetermined schedule. In most cases, step-ups become callable by the issuer on each anniversary date that the coupon resets or continuously after an initial non-call period.

Deferred Coupon Bonds | Definition, How it works? Types, Advantages Deferred Coupon bonds help businesses acquire finance without paying periodic interest. A lump-sum is paid including interest at the time of maturity. ... a company paying 4% interest on step-up bonds defers interest payments till maturity. On maturity, the company will pay interest at an increased rate (say) 5.5% for all the deferred periods. ...

Novartis stirs debate with first social-linked step-up coupon bond In the formats used so far, investors will receive a 25bp step-up in the coupon if, on a certain date, the issuer has failed to hit a sustainability target. For Enel and Suzano, these were to...

What Do I Need to Know About Step-Up Bonds? | Finance - Zacks One-step bonds have their coupon payment stepped up once during the life of the bond. For example, the coupon payment on a five-year bond may be 5 percent in the first and second...

:max_bytes(150000):strip_icc()/AgencyBonds_LimitedRiskAndHigherReturn32-9a575588ab6b4e4484cc80d0a8f9710c.png)

:max_bytes(150000):strip_icc()/investment-3999136_1920-7e692563c3ea473d968c27d90ba7c5c6.jpg)

Post a Comment for "43 step up coupon bonds"