43 duration of a coupon bond

Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is: What is the duration of a bond? and How to Calculate It? Usually, the duration of a bond shows the number of years in which an investor can recover the present value of the cash flows of a bond. It can also represent a percentage that is a measure of how sensitive the value of the bond is to changes in interest rates. The duration of a bond is simple to understand.

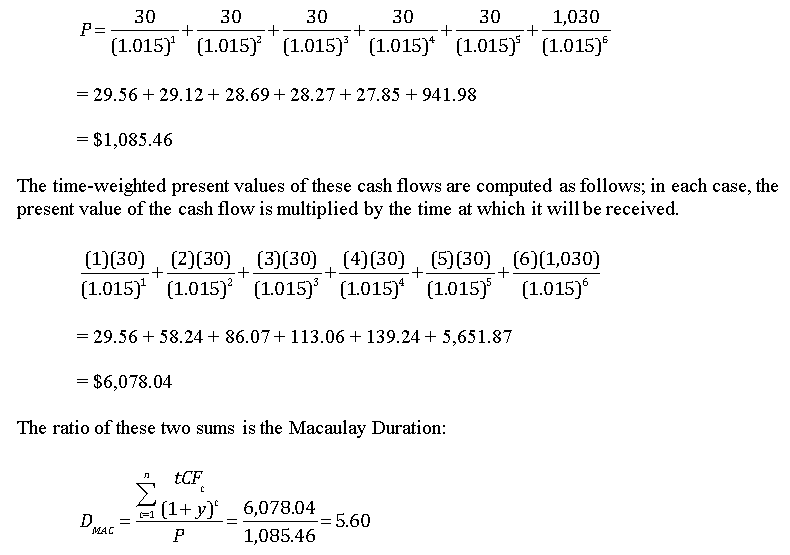

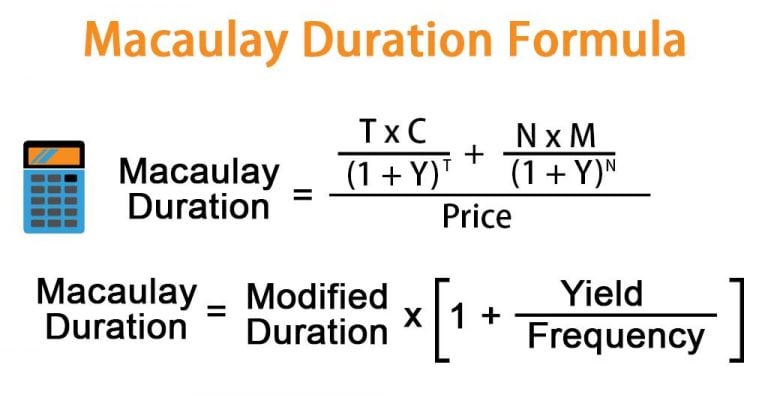

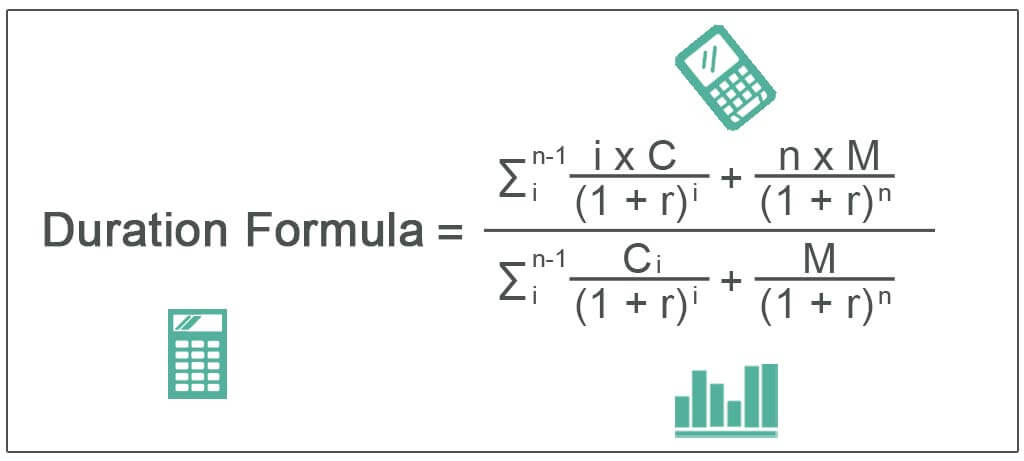

5minutefinance.org: Learn Finance Fast - Duration The Duration of a zero-coupon bond is the number of years until maturity. Also note, we can calculate the duration of a bond portfolio as the weighted average of the duration of all of the individual the bonds in the portfolio. Modified Duration. Macaulay Duration is a bit off however, so we adjust it by dividing it by `(1+YTM)`. ...

Duration of a coupon bond

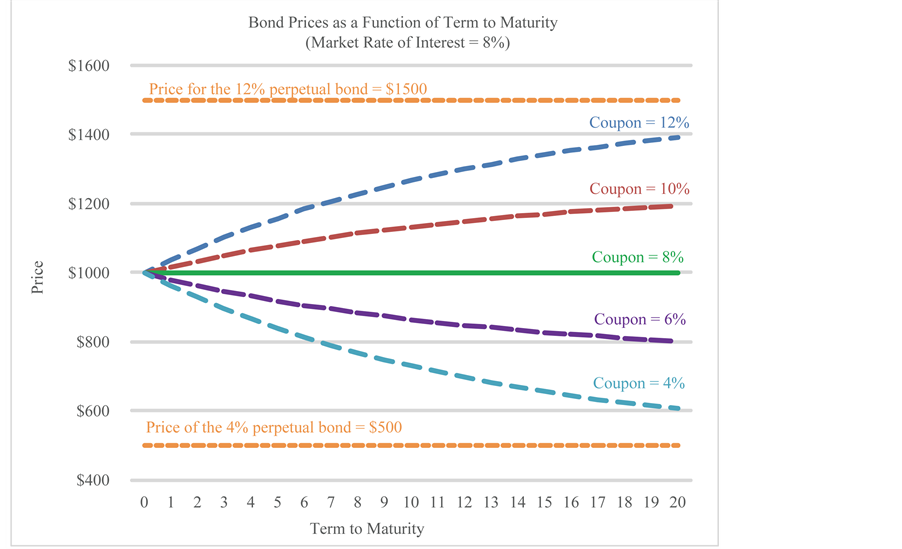

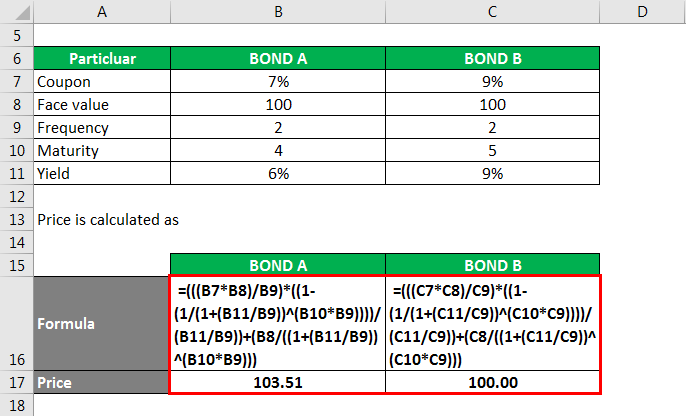

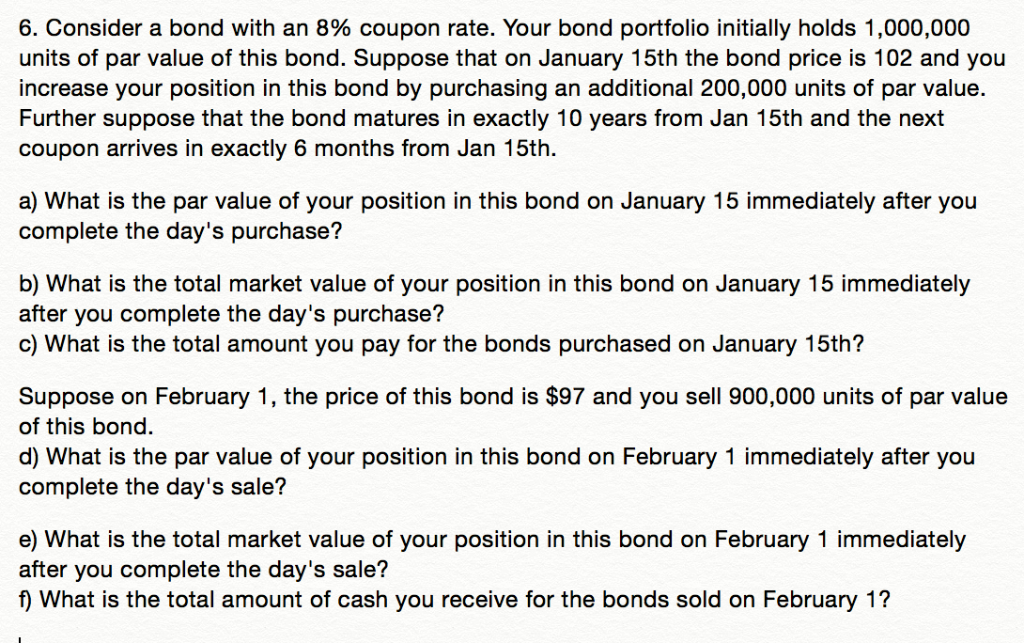

What Is Duration of a Bond? - TheStreet Definition - TheStreet For example, if interest rates rose by 2%, a 10-year Treasury with a coupon of 3.5% and a duration of 8.4 years would fall in value by 15%. Long-Term Bonds Let's use the 30-year Treasury with 4.5%... Duration vs. Maturity and Why the Difference Matters 1.9.2017 · See the diagram below to understand the relationship between the bond’s price and its interest rate (or coupon rate). A bond is quoted with its “coupon yield”. This refers to the annual interest payable as a percent of the original face or par value. An 8% bond with a par value of 1000 would receive $80 per year. Coupon/Interest Rate= 8% Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

Duration of a coupon bond. Understanding the duration of a bond - Baker Tilly Bond yields and prices are inversely correlated. When yields go up, prices go down. When rates fall, prices go up. If rates drop by 1%, the new price of the bond is $105 ($100 plus the five duration). Duration is a measure of risk. The price of a bond is the sum of the present value of its cash flows. A zero-coupon bond is purchased at a ... fixed income - Duration of a floating rate bond - Quantitative … Yes. the duration of a floating rate bond is the time t until the next coupon payment, as your equation shows. The payments that come after are not known yet and will be determined based on interest rates then prevailing, so they carry no duration risk. In general floating rate bonds are what people buy when they want the smallest duration ... Bond Duration Calculator - Exploring Finance The bond duration calculator can be used to calculate the bond duration. Example is included to demonstrate how to use the calculator. Skip to content. ... Additionally, since the bond matures in 2 years, then for a semiannual bond, you'll have a total of 4 coupon payments (one payment every 6 months), such that: t 1 = 0.5 years; t 2 = 1 years; Understanding the Relationship Between Coupon Rates and Duration A high coupon rate bond provides more cash flow than a low coupon rate bond. Accordingly, a high coupon rate bond has a lower duration that a low coupon bond. For example, if I purchase a zero-coupon bond on its issue date the bond will have a duration of 30 years - no cash flow until the bond matures.

The dynamics of bond duration and rising rates | Vanguard 18.11.2021 · Your investment horizon matters. Rising interest rates can be good for bond investors if their investment horizon is long enough. Figure 1 shows the effect of the investment horizon on a hypothetical investment in a bond maturing in 15 years that pays a coupon of 0.9% annually when interest rates are at 2%. The bond’s weighted average Macaulay duration is 14 … Duration: a measure of bond price volatility | Nuveen In our previous example, the par bond had a modified duration of 8.58 years and a maturity of 10 years. If a bond with the same coupon rate and price had a maturity of 11 years, its modified duration would be 9.31 years. If the coupon were raised to 4.00%, but with the same 3.00% yield, the modified duration would be reduced back to 8.98 years. Bond duration - Wikipedia For example, a standard ten-year coupon bond will have a Macaulay duration of somewhat but not dramatically less than 10 years and from this, we can infer that the modified duration (price sensitivity) will also be somewhat but not dramatically less than 10%. Duration of Bonds | Premium Bonds - PFhub Duration of the Two Basic Bond Types. Zero Coupon Bond: For a zero coupon bond, duration is the same as its maturity period. For a zero coupon bond, the fulcrum on the seesaw would be placed right under the bond's future value money bag at the maturity period (right most end of the plank), balancing its load right under. This is because the ...

Macaulay Duration - Investopedia A coupon-paying bond will always have its duration less than its time to maturity. In the example above, the duration of 5.58 half-years is less than the time ... Dollar Duration - Overview, Bond Risks, and Formulas Dollar Duration. The change in the price of the bond for every 100 bps (basis points) of change in the interest rate. Written by CFI Team. Updated August 31, 2021. ... It means that as interest rates fall, bond coupon rates increase. Short-term bonds are less sensitive to interest changes, while a 20-year long-term bond may be more sensitive to ... Bond (finance) - Wikipedia In finance, a bond is a type of security under which the issuer owes the holder a debt, and is obliged - depending on the terms - to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time.Interest is usually payable at fixed intervals (semiannual, annual, and less frequently at other periods). Understanding bond duration - Education | BlackRock It's lost some appeal (and value) in the marketplace. Duration is measured in years. Generally, the higher the duration of a bond or a bond fund (meaning the longer you need to wait for the payment of coupons and return of principal), the more its price will drop as interest rates rise. How duration affects the price of your bonds

PDF Understanding Duration - BlackRock rates, duration allows for the effective comparison of bonds with different maturities and coupon rates. For example, a 5-year zero coupon bond may be more sensitive to interest rate changes than a 7-year bond with a 6% coupon. By comparing the bonds' durations, you may be able to anticipate the degree of

Duration & Convexity - Fixed Income Bond Basics | Raymond James The duration of a bond will be higher the lower its coupon. Duration will be higher the lower its yield. Duration will also be higher the longer its maturity. The following scenarios of comparing two bonds should help clarify how these three traits affect a bond's duration: If the coupon and yield are the same, duration increases with time ...

Convexity of a Bond | Formula | Duration | Calculation So the price would decrease by only 40.64 instead of 41.83 . This shows how, for the same 1% increase in yield, the predicted price decrease changes if the only duration is used as against when the convexity of the price yield curve is also adjusted.. So the price at a 1% increase in yield as predicted by Modified duration is 869.54 and as predicted using modified duration Modified …

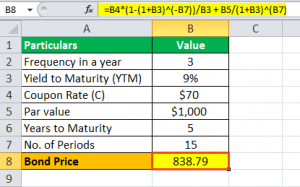

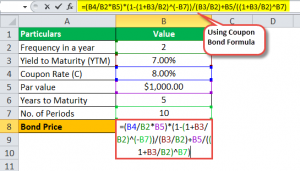

How to Calculate the Bond Duration (example included) PV = Bond price = 963.7 FV = Bond face value = 1000 C = Coupon rate = 6% or 0.06 Additionally, since the bond matures in 2 years, then for semiannual bond you'll have a total of 4 coupon payments (one payment every 6 months), such that: t1 = 0.5 years t2 = 1 years t3 = 1.5 years t4 = tn = 2 years

Bond Duration Calculator – Macaulay and Modified Duration Coupon Payment Frequency - How often the bond pays interest per year. Calculator Outputs Yield to Maturity (%): The yield until the bond matures, as computed by the tool. See the yield to maturity calculator for more details. Macaulay Duration (Years) - The weighted average time (in years) for the bond's cash flows to pay out.

Duration of a Bond | Portfolio Duration | Macaulay & Modified Duration Therefore, the Macaulay bond duration = 482.95/100 = 4.82 years. And Modified Duration= 4.82/ (1+6%) = 4.55%. The above calculations roughly convey that a bondholder needs to be invested for 4.82 years to recover the cost of the bond. Also, for every 1% movement in interest rates, the bond price will move by 4.55% in the opposite direction.

Coupon Bond - Investopedia The coupon rate is calculated by taking the sum of all the coupons paid per year and dividing it with the bond's face value. Real-World Example of a Coupon Bond If an investor purchases a $1,000...

Duration Formula (Definition, Excel Examples) | Calculate Duration of Bond Duration = 63 years; The calculation for Coupon Rate of 4%. Coupon payment = 4% * $100,000 = $4,000. The denominator or the price of the bond Price Of The Bond The bond pricing formula calculates the present value of the probable future cash flows, which include coupon payments and the par value, which is the redemption amount at maturity. The yield to maturity (YTM) …

Duration | Definition & Examples | InvestingAnswers Duration changes every time a bond makes a coupon payment, shortening as the bond nears maturity. 3. Yield to Maturity The higher a bond's yield to maturity, the shorter its duration. That's because the present value of the distant cash flows (which have the heaviest weighting) become overshadowed by the value of the nearer payments. 4.

The Macaulay Duration of a Zero-Coupon Bond in Excel The Macaulay duration of a zero-coupon bond is equal to the time to maturity of the bond. Simply put, it is a type of fixed-income security that does not pay ...

How to Calculate Bond Duration - wikiHow To calculate bond duration, you will need to know the number of coupon payments made by the bond. This will depend on the maturity of the bond, which represents the "life" of the bond, between the purchase and maturity (when the face value is paid to the bondholder).

Bond Duration: Everything You Need to Know - SmartAsset How Coupon Rate Impacts Duration. Coupon rate is the interest yield of a bond. This is an annual rate. So if you have a $1,000 bond with a 5% coupon, you will earn $50 of interest from the bond each year (5% of $1,000). A bond will pay this amount in addition to its par value.

Bond Duration | Formula | Excel | Example - XPLAIND.com As mentioned above, duration of a zero-coupon bond equals it outstanding term, while in other cases, it is less than the term of the debt instrument. Bond B is less risky than Bond C even though they have equal terms because it has higher coupon rate.

Macaulay's Duration | Formula | Example - XPLAIND.com Duration of Bond A is 4.5, i.e. the maturity period (in years) of the zero-coupon bond. Duration of Bond B is calculated by first finding the present value of each of the annual coupons and maturity value. Annual coupon is $50 (i.e. 5% of the $1,000) and the maturity value is $1,000.

Duration and Convexity, with Illustrations and Formulas Money › Bonds Duration and Convexity. Bond prices change inversely with interest rates, and, hence, there is interest rate risk with bonds. One method of measuring interest rate risk due to changes in market interest rates is by the full valuation approach, which simply calculates what bond prices will be if the interest rate changed by specific amounts.

What is the duration of a zero coupon bond? - Quora Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount with par value paid on redemption, sometimes with a nominal premium.

/bond_duration-5bfc37fd46e0fb00260e7d1c.jpg)

Post a Comment for "43 duration of a coupon bond"